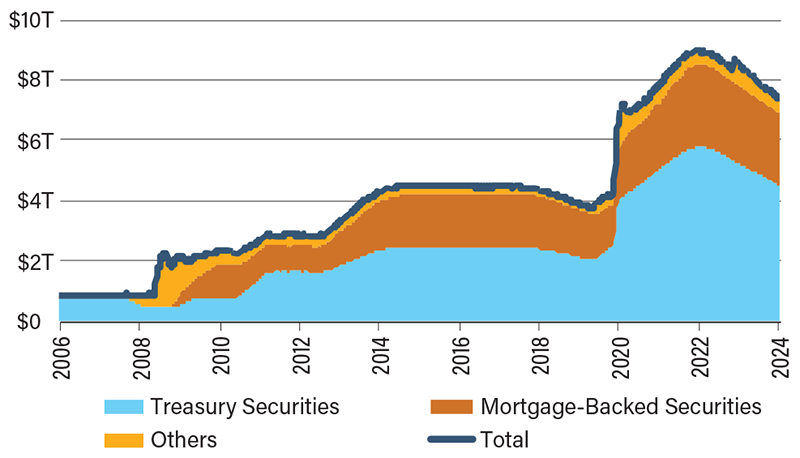

Fed Slows Balance Sheet Reduction

The first half of 2024 is coming to an end. Unfortunately, our long-awaited interest rate cuts are not here yet, and it has become increasingly unclear when they will happen. However, the Federal Reserve officially announced its plan to put one thing in motion: a slower pace of balance sheet reduction.

Known by the fancy name of “quantitative tightening,” “balance sheet reduction” is a more accurate term for when a central bank shrinks the size of its asset holdings in an effort to reduce liquidity in the economy. Contrary to what some believe, the Fed is not selling bonds to cut its balance sheet. It’s simply allowing Treasury and agency securities—such as mortgage-backed securities—to expire without reinvestment unless the maturing amounts exceed a monthly cap. Since the start of the current balance sheet reduction in June 2022, that monthly cap has been set at $60 billion for Treasury securities and $35 billion for agency securities. That means balance sheet reduction could not exceed $95 billion per month.

In May 2024, the Fed announced its plan to slow the speed of balance sheet reduction. Starting in June 2024, the monthly cap for Treasury securities will be lowered to $25 billion while the cap for agency securities remains at $35 billion. This means the amount of expired Treasury securities that exceeds $25 billion will get reinvested each month. The particular choice to slow the runoff pace of only Treasury securities suggests the central bank is starting to take more caution of its impact on the money market and, indeed, the entire financial system.

Back in 2019, when the Fed implemented balance sheet reduction for the first time and caused turbulence in the repurchase agreement (“repo”) market, it learned the hard lesson that, while it could inject trillions of dollars within weeks, taking a small fraction of that back without causing a crisis takes years. It’s like signing up for a subscription with only one click, but canceling it requires hours of phone calls with customer service—assuming they even let you off the hook.

Federal Reserve Balance Sheet

SOURCE: Federal Reserve.