Gen Z Faces Struggles, Achieves Surprising Home Ownership

Gen Z Faces Struggles, Achieves Surprising Home Ownership

Whether they’re graduating from college or entering the trades, young Americans face two critical hurdles to establishing themselves: securing employment and managing their finances. In an increasingly unpredictable labor market shaped by the rise of artificial intelligence (AI) and economic volatility, this task is proving especially difficult for Generation Z (those born roughly between 1997 and 2012).

To understand the obstacles that young people face, it’s important to first consider the broader economic landscape. Though the United States has so far avoided a recession amid fiscal policy uncertainty, the low unemployment rate may be misleading. Job additions have risen modestly, but labor force participation has been below pre-COVID levels. The unemployment rate for college graduates ages 22–27 stands at 5.8%, well above the national average of 4.1%.

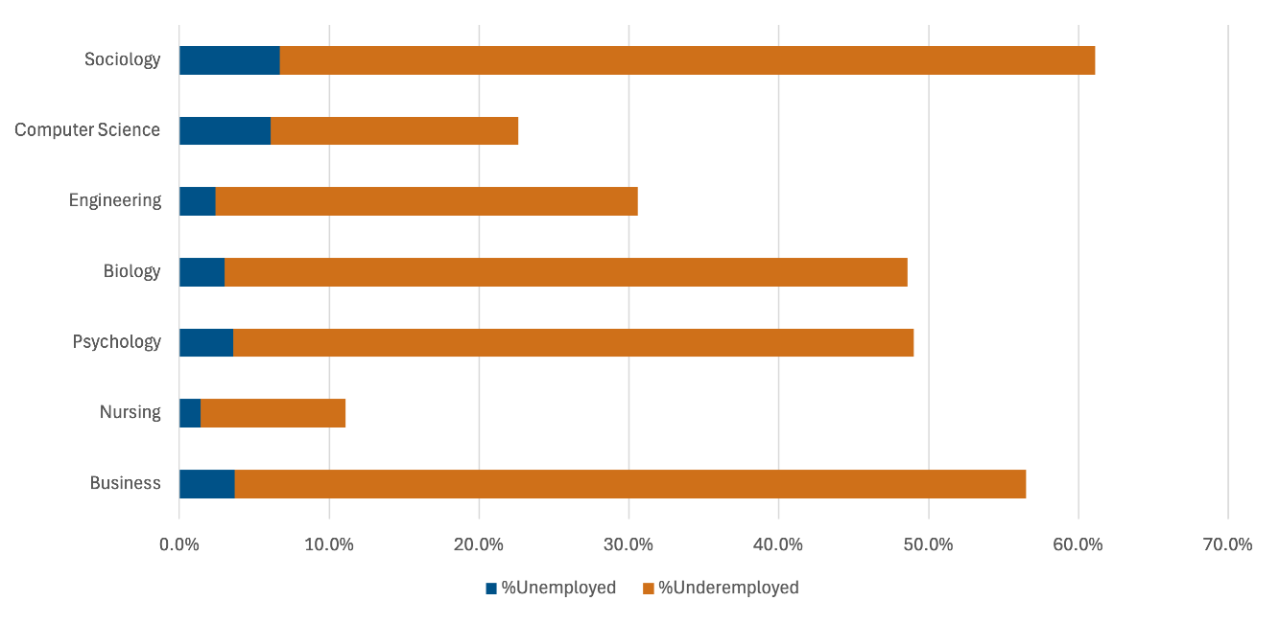

Although recent college graduates make up only 5% of the workforce, they account for 12% of the increase in unemployment since 2023. Slowing job growth and weakened private sector hiring have made it harder for new entrants to gain a foothold in the market. Even among those who have found jobs, nearly 40% are “underemployed”—meaning they work only part-time or in roles they are notably overqualified for.

These challenges aren’t unique to degree-holders. Industries like manufacturing, nonspecialty construction and mining, which do not usually require a college degree, have posted net job losses for most of 2025. In addition, adoption of AI across the workforce promises to reshape industries from finance to farming. The CEO of Anthropic, an AI startup, predicted that nearly half of all entry-level roles could be automated within five years, while Bloomberg warned readers to embrace AI in the workplace or risk being replaced entirely.

For those who are earning a steady paycheck, financial pressures persist. While hourly wages have increased about 24% since 2020, the cost of essentials has skyrocketed. Rent increased nearly 40% over that period, and median home prices have increased nearly 52%. About 55% of Gen Z adults list either cost of living or unemployment as their main concern about the world, and only 28% believe the economy will improve in the next year. Gen Z is also the first American generation projected to earn less than their parents did at age 30, reflecting that wage increases lag behind inflation.

Despite these formidable challenges, the outlook isn’t entirely bleak. Unemployment trends are expected to improve by 2027, and industries such as health care and hospitality continue to experience strong growth. By choosing their major wisely, rising college students can also focus on areas experiencing growth. Gen Z has embraced the integration of AI, leading to increases in productivity and potentially creating new roles in place of automated jobs.

Also on the bright side: Gen Z has a higher home ownership rate at age 24 than millennials or Gen X. Nearly 60% of adult Gen Zers also anticipate an improvement in their personal financial situation over the next year, the highest percentage since the pandemic. Success for this generation will likely depend on adaptability and willingness to navigate economic uncertainty and technological change, but it remains within reach.

Unemployment and Underemployment in America's Most Popular College Majors

Source: New York Fed.

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| Consumer Price Index (June)(YoY) | 2.4% | 2.7% | 2.7% |

| Shelter Inflation (June)(YoY) | 3.9% | N/A | 3.8% |

| 5-Year Inflation Expectations (July) | 4.0% | 4.0% | 3.8% |