Grid Charged: How BESS Is Reshaping Energy

Battery energy storage systems (BESS) are rapidly expanding in capacity and functionality across the U.S. power grid. In 2024, a record 10.3 GW of new storage capacity was added, according to the U.S. Department of Energy (DOE). The DOE projects that 18 GW of utility-scale battery storage will be added in 2025, surpassing last year’s historic growth.

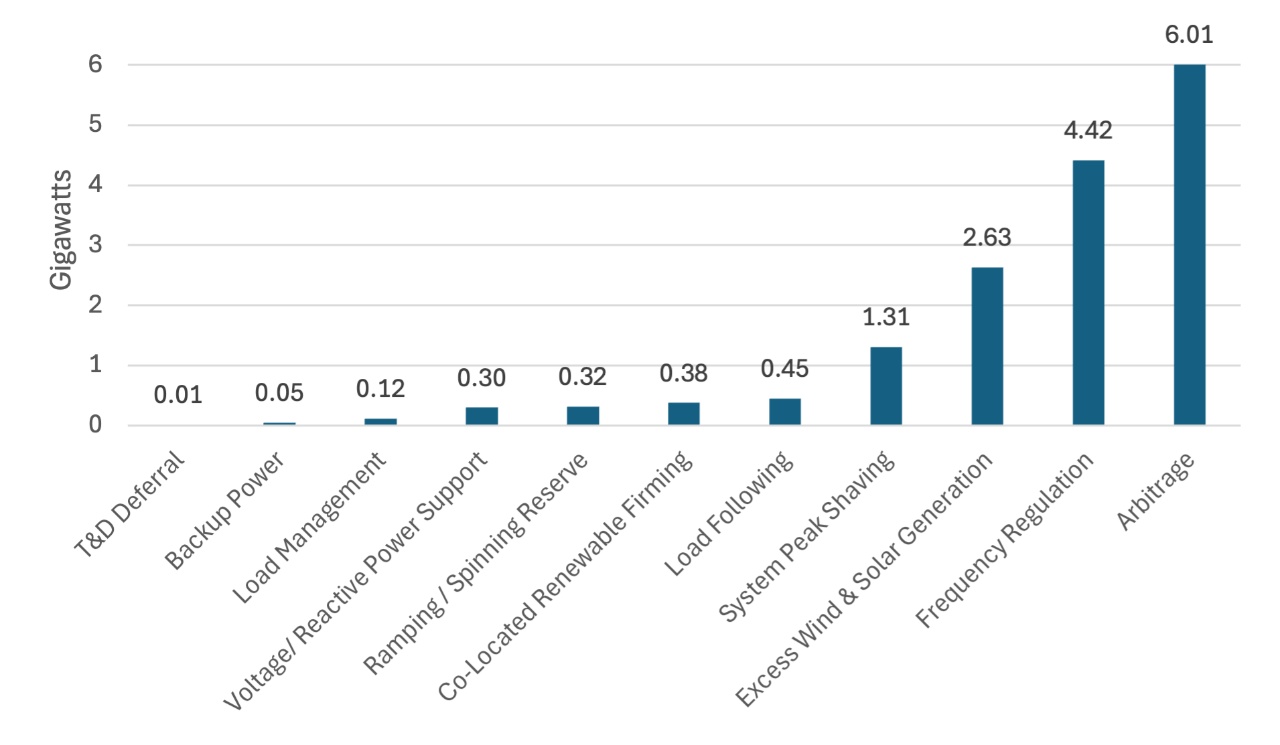

“Although BESS are not primary electricity generators, they play a vital role in enhancing grid stability,” CFC Senior Energy Industry Analyst Alisha Pinto said. “They help balance intermittent renewable energy sources like solar and wind, provide ancillary services such as frequency regulation and enable price arbitrage by storing energy when prices are low and discharging when prices are high.”

Primary Applications Served by Large-Scale Battery Storage in 2023

SOURCE: Department of Energy, 2024.

Texas and California are leading the BESS charge and are expected to account for 82% of new storage capacity in 2025. These states have seen significant growth in solar and wind generation in recent years. Storage has become a key asset for grid reliability. During the 2024 summer heatwaves, battery storage in Texas helped prevent blackouts by discharging during peak evening demand. The Electric Reliability Council of Texas reported record load growth in August 2024, with BESS setting new milestones for both energy discharge and technology utilization.

“Looking ahead, the BESS sector is poised for continued growth, but challenges remain,” Pinto said. “The industry faces supply chain bottlenecks and is heavily reliant on imports from China, which dominates the global battery value chain—from raw material processing to component manufacturing.”

Increased tariffs on imports are adding further volatility to prices and availability. According to Wood Mackenzie, depending on the ultimate severity of these new tariffs, long-term BESS costs could increase by 12% to 50%.

“In the medium- to long-term, domestic manufacturing and technological innovation may help mitigate tariff risks,” Pinto said. “The U.S. is beginning to develop its own battery production capabilities, particularly in emerging technologies such as long-duration energy storage.”

As BESS continue to scale rapidly, electric cooperatives are advised to adopt a strategic and holistic approach to integration.

“To maximize value, cooperative staff should develop robust business cases, compare BESS with alternative solutions, such as demand response programs, and thoroughly assess all available options,” Pinto said.

Regional collaboration—through generation and transmission cooperatives and statewide associations—can enable cooperatives to share insights, mitigate risks and make more informed investment decisions.

“These initiatives should be embedded within a comprehensive risk mitigation strategy that prioritizes long-term reliability, financial resilience and enhanced member value,” Pinto concluded.