Gen X Borrowers Are Defaulting More Often on Student Loans

You finally land a job out of college, your first paycheck hits and your credit score plummets. Welcome to the new reality of student debt, where the rollback of pandemic-era protections has led to a surge in delinquency.

The federal government paused student loan repayment from the beginning of the 2020 pandemic to September 2023. After the restart, a one-year ramp-up program was created that stopped the reporting of missed loan payments to credit bureaus until October 2024. Following the end of the grace period, the first quarter of 2025 saw nearly one in four federal student loan borrowers behind on their payments. After 90 days of overdue loans, they are classified as delinquent and reported to credit bureaus. While these numbers represent a return to pre-COVID levels of student loan issues, the profile of a delinquent borrower has changed.

Borrowers more than 90 days behind on their payments are now more likely to be over 40 and concentrated in the South, while borrowers aged 18–29 are more likely to be current on payments compared with 2020. Of those aged 40–60+ with student loan debt, 25% are delinquent. This shift highlights the altered landscape of student loans over the past five years and the difficulty many borrowers face in returning to a normal payment schedule.

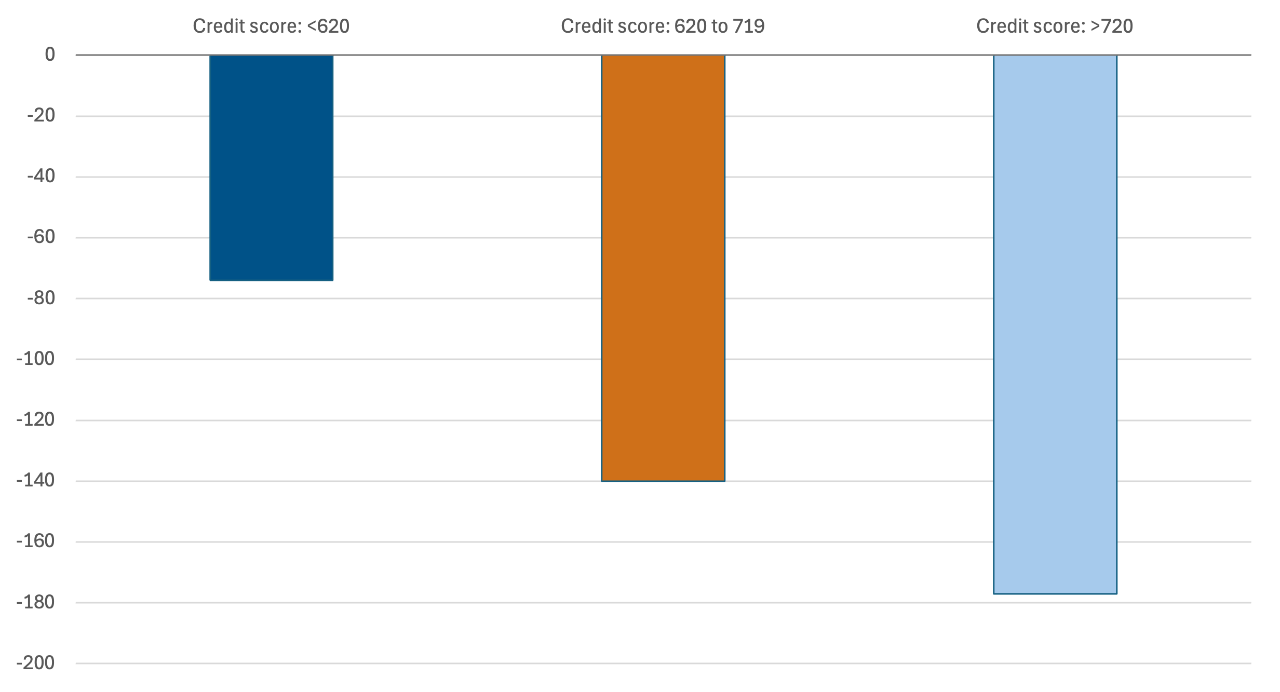

You might expect these delinquent borrowers to be experiencing wider financial struggles or have a history of credit mismanagement. However, this is not the case; increased delinquency rates span the credit scale. For the 43.4% of newly delinquent borrowers who had a credit score greater than 620 before missing or defaulting on a student loan payment, the consequences can be severe. Their scores may drop up to 177 points, which will have a drastic impact on their ability to access new credit. Increased borrowing costs or denial for auto and home loans could be an unpleasant surprise for these borrowers who previously enjoyed the benefits of a high credit score.

Reduced access to credit could have broader economic consequences, dampening consumer spending, delaying home ownership, and increasing insurance and interest rate premiums. In an economy already swirling with uncertainty, student loans have flared as another cause for concern—and this time, there’s no pause button.

Average Credit Loss by Score for Delinquent Student Loan Borrowers

SOURCE: New York Fed.