When Will Fed Cut Rates? CFC Expert Offers His Best Guess

In the short-run, many things can cause inflation: from weather that disrupts supply chains, to families having more children, to people believing they will be wealthier in the future. But in the long-run, supply chains recover, families economize and beliefs get reality-checked. In the long-run, inflation is due to only one thing: the money supply growing faster than the production of goods and services.

That simple fact goes a long way to answering the question that has been vexing economists and financial analysts for over a year: When will the Federal Reserve cut interest rates? Last July, forecasters predicted one rate cut in Q1 of this year, two more cuts in Q2, a fourth cut in Q3, and a fifth and sixth in Q4. But, month after month from then until now, forecasters have tempered their expectations. The current consensus is one cut in Q3 and a second in Q4 of this year.

If we put aside the usual discussions about recessions, the stock market, housing prices and unemployment, and return to the fact that, fundamentally, inflation is what you get when the money supply grows faster than the production of goods and services, we can gain some insight into why the experts were consistently wrong about when the Fed might actually start to cut rates.

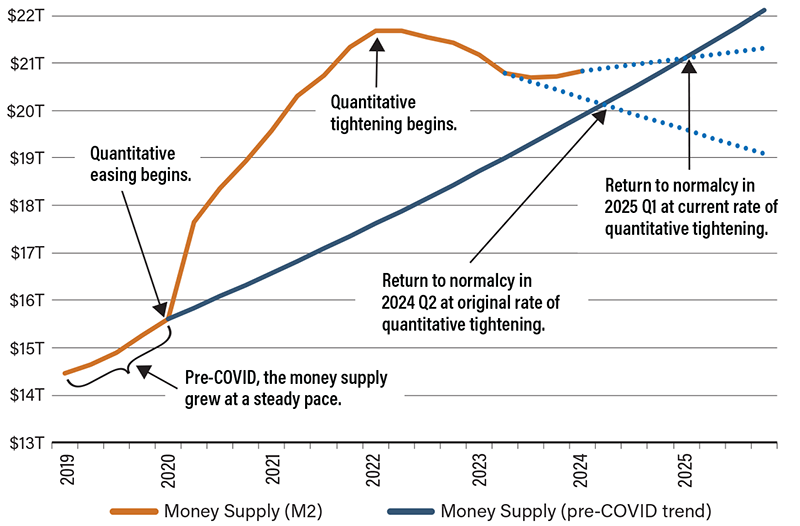

The nearby graph shows the steady growth in the money supply prior to COVID, the rapid increase in the money supply with quantitative easing that started in Q1 of 2020 and the quantitative tightening that began in Q1 of 2022 as the Fed detected rising inflation.

At the Fed’s original rate of tightening, the money supply would have returned to its pre-COVID trend by Q2 of this year. This is why experts were predicting multiple cuts in 2024. But, fearing a recession, the Fed slowed its rate of tightening in Q3 of 2023. Now, on its new and slower trajectory, the money supply won’t return to its pre-COVID trend until Q1 of 2025.

Given this, and barring an unexpected recession, my best guess is that we’ll not see the first rate cuts until the beginning of 2025.

Effect of Quantitative Tightening on Money Supply

SOURCE: Federal Reserve of St. Louis.