What a Blast: Housing Market Boom Remains Hot

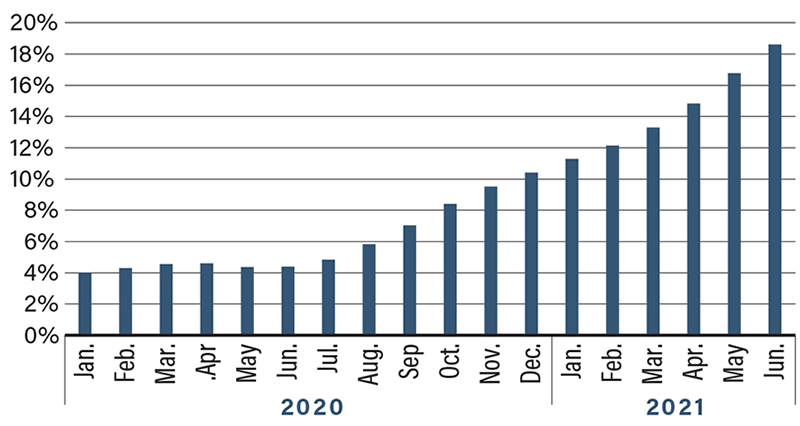

The U.S. housing market continues to operate like a blast furnace with home prices rising more than they have in 30 years. The S&P CoreLogic Case-Shiller index of property values nationwide surged 18.6 percent in June from a year earlier. That followed a 16.8 percent gain in May, marking the 13th straight monthly price acceleration since June 2020.

June’s increase was the largest in housing data going back to 1988 as buyers, armed with big down payments and cheap mortgages, competed for a tight supply of homes, fueling bidding wars across the country. The current market is reminiscent of 2008, though back then prospective homebuyers were more highly leveraged than today’s cash-laden consumers.

Phoenix Market Is Hot, Hot, Hot

Market-wise, the last several months have been extraordinary not only in terms of price gains, but also in their consistency across the country. The Case-Shiller national index, a broad measure of prices in 20 U.S. cities, climbed 19.1 percent, beating the market consensus for June. Price appreciation has been greatest in the West where supply is highly constricted and demand remains robust. Among the 20 cities surveyed, Phoenix led the way with a 29.3 percent gain, followed by San Diego at 27.1 percent and Seattle at 25 percent. The key drivers of higher home values are the persistent lack of housing supply along with elevated homebuilding costs. Unfortunately, the unrelenting price increases are making it hard for buyers to find properties they can afford.

Low Rates, Rising Wages Will Extend the Boom

Don’t expect housing demand to diminish anytime soon. Mortgage rates are expected to remain low and homebuilders are ramping up construction activity despite higher material and land costs. Other housing drivers continue to move in the right direction, which will support near-term price appreciation. The labor market is healing quickly and is on track to recoup its prerecession level by the end of 2022, much faster than the performance in the wake of the Great Recession over a decade ago. In turn, solid wage growth will help bolster the finances of potential homebuyers and better enable them to save for a down payment. Expect home prices to remain hot through the end of this year and into 2022 supported by limited supply and strong demand.

S&P CoreLogic Case-Shiller Home Price Index National Average