Transitory Inflation: A Jedi Mind Game?

Federal Reserve Chairman Jerome Powell and his comrades have spent months preaching to anyone who would listen that the recent spike in U.S. inflation is merely “transitory.” They figure if they repeat it often enough it will lull people into actually believing it—similar to a Jedi mind trick. However, The Force may not be as strong for the Fed as Mr. Powell would like. Numerous polls and consumer sentiment surveys show inflation has become a top concern for many Americans. And, worse yet, people are predicting inflation will stay high.

Rising inflation is triggering anxiety around the world as the surge in demand following COVID-19 lockdowns has been confronted by supply bottlenecks and rising prices of energy and raw materials. The rebound in demand came much quicker and stronger than the usual aftermath of an economic contraction. Supply disruptions have wreaked havoc across the globe and seem to be worsening, which may jeopardize the outlook for the post-pandemic economic recovery. Real gross domestic product has already peaked and is expected to trend lower thanks to a multitude of headwinds such as virus variants, supply shortages, shipping woes, inflationary pressures, rising energy prices, monetary tightening and Washington politics. All these factors should slow the growth trajectory moving forward, which could help moderate the recent price rise.

With higher food, clothing and energy prices hitting consumer pocketbooks, it appears as though many people are not buying the Fed’s psychological games. Consumer confidence is fading. In fact, buyers are so spooked that recent polls show Americans’ plans to buy new houses and cars are at the lowest levels seen since the early 1980s. What does transitory mean anyhow? According to the new world dictionary, it means “of a passing nature.” The problem is, there is no mention of how long that period of passing could last.

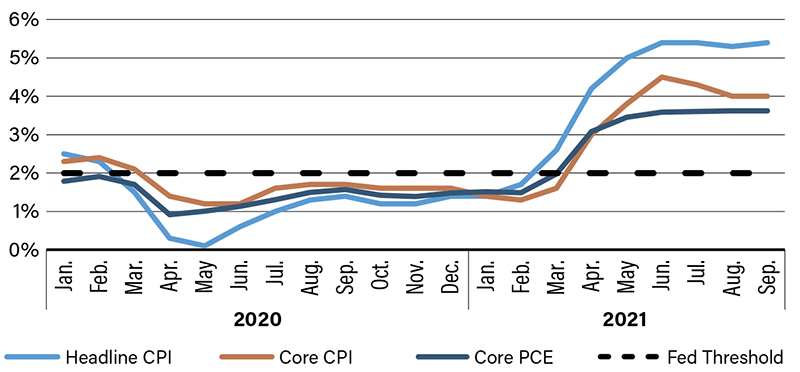

Reports in October showed U.S. inflation is running at a 13-year high of 5.4 percent, and it’s not just a U.S. issue. Of the 38 central banks tracked by the Bank for International Settlements, 13 have raised their key rate at least once in response to higher prices. Will the U.S. be next?

U.S. Inflation Measures