The Yield Curve’s Inverted! Wait, What Does That Mean?

“Inverted yield curve” is a term beloved by many economists—mostly for two reasons. First, it’s one of the most accurate leading indicators of a recession. Second, no one understands it. Simply put, an inverted yield curve is when yields on short-term Treasury issues are higher than those on long-term ones. It’s an unusual phenomenon because long-term interest rates are supposed to be higher given their greater uncertainty. For decades, when the yield curve inverted, a recession always followed. No one can explain exactly why that happens, but let’s take a look.

Let’s first begin with statisticians’ beloved phrase: “Correlation doesn’t imply causation.” Just because a recession almost always follows an inverted yield curve, it doesn’t mean that an inverted yield curve causes a recession. It simply means the two events are correlated. Perhaps there’s something else that causes both.

When the Federal Reserve raises its overnight rate, Treasury bills, the shortest-term Treasury issues, are predictably impacted because they compete with the federal funds rate in the money market. Hence, the short-term yields quickly increase. Meanwhile, long-term rates move more slowly, especially if markets believe that the Fed will cut rates and bring them down to where they were in the long run. It is this belief that leads to an inverted yield curve. As time passes, either the Fed cuts its overnight rate, which also brings down other short-term rates, or markets finally wake up to the reality that rates will be higher for longer. Long-term rates then begin to rise very quickly. This resembles the current economy.

Once long-term rates rise significantly, the economy will begin to feel real pain. It is possibly the inflection point of the business cycle. Particularly, the 10-year Treasury yield is a baseline against which investment risks are assessed. Mortgage rates track the 10-year Treasury yield very closely. Other interest rates, such as those on corporate bonds and money market accounts, are compared with or benchmarked against Treasury yields. So, when the yield curve inversion becomes smaller or ends—meaning long-term rates catch up to short-term rates—a recession tends to follow. It isn’t that an inverted yield curve predicts a recession, but it is an illustration of the long and variable lag of the impact of monetary tightening, which almost always triggers a recession.

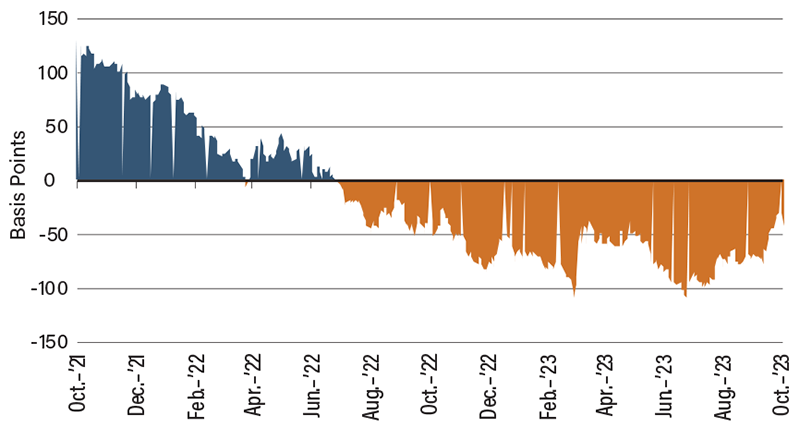

Inverted Yield Curve: 10-Year US Treasury Yield

Minus 2-Year US Treasury Yield

SOURCE: Federal Reserve Bank of St. Louis.