How Two Applications Explain the Current Economic Divide

Be honest—how are you doing financially? Hopefully, the answers from our readers are nothing less than financially okay. How you experience the current economy depends on whether you’re in the group applying for American Express credit cards or the group applying for small personal loans at Upstart, an online lending company. Interestingly, both groups are on the rise, which helps explain the disconnect in views on the state of the economy.

In the first quarter, American Express—whose cards are a symbol of status and typically carry high annual fees—added 3.4 million new cardholders. Spending in the quarter totaled $419 billion, an increase of 5% from a year ago. Whether you have an American Express card or not, you fall into this category if you travel, do fine dining and have investment accounts that have made substantial gains because NVIDIA kept breaking records. You probably own a home that you bought either when mortgage rates were less than 4% or when home prices were half what they are now. Although inflation bothers you, you’re more focused on economic growth. That, or you’re one of the increasing number of American Express cardholders who carry a balance despite high interest rates, because you only live once.

Then there’s the second group—we’ll call you the Upstart group. In the first quarter, originations of loans of up to $2,500—known as “relief loans,” which are used to cover expenses like rent and other bills—jumped 80%. Those who turn to lenders such as Upstart are likely to live paycheck to paycheck. Your biggest expense, which is housing, has probably gone up significantly, because in the ‘90s you were attending elementary school instead of investing in real estate. Now, you have to either pay high rent or borrow at high rates to pay for high home prices. You don’t own stocks—let alone a 401(k) account. For you, inflation is not only high, it’s strangling you to your last penny.

American Express group and Upstart group, please meet each other. You may be classmates, co-workers or even friends. Both of your experiences are valid. It’s not you—it’s the economy.

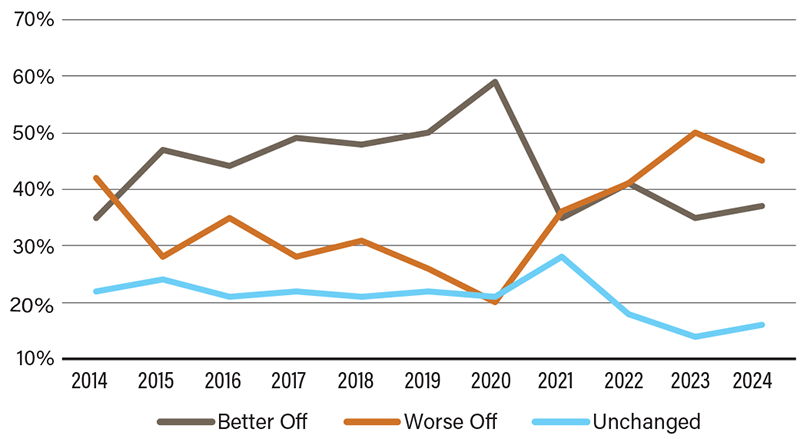

Personal Financial Situation Change from a Year Ago

Source: Gallup.