Fed Chief Knows All Too Well that We Want Rate Cuts

With just one look at Federal Reserve Chairman Jerome Powell, anyone could tell that never in his wildest dreams did he expect to cause so much excitement speaking in front of the media’s cameras. In fact, never in my wildest dreams did I imagine paying this much attention to words coming from someone other than Taylor Swift. Yet here we are.

On May 1, 2024, Powell took to the podium with just one thing in mind: how to not make the biggest headline on the front page. The Fed decided to hold the target federal funds rate at 5.5% and significantly slow the pace of its balance sheet reduction (less tightening). Powell noted that disinflation progress has stalled while growth has remained strong—not entirely true given the latest gross domestic product data, which was much weaker than expected.

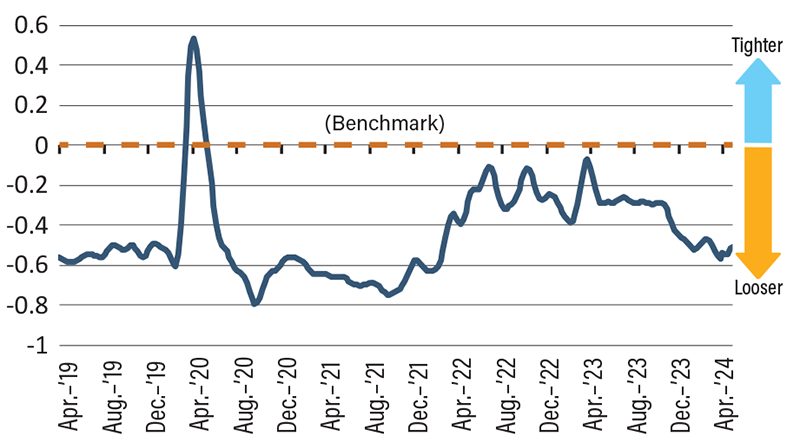

The central banker also said there’s no plan for additional rate hikes and that rates are restrictive enough. Contrary to this statement, the National Financial Conditions Index created by the Chicago Fed shows that financial conditions have remained accommodative to growth throughout the current cycle.

Evidence of inflation plateauing above the target rate or even reaccelerating is everywhere, and yet it came as a surprise to experts and the Fed—although it shouldn’t have because analysis of inflation drivers points to the risk of sticky inflation, as we foretold in our 2024 Economic and Industry Trends report. Parts of inflation caused by supply chain pressure have mostly faded. What’s left are the parts driven by loose financial conditions induced by excessive capital injections.

The Fed has made three key mistakes: overstimulating the economy in response to COVID; delaying corrective action against inflation; and pausing rate hikes too soon. Now it’s in a difficult position that could lead to a fourth mistake, likely one of the following: cutting rates too early, which will risk inflation resurging; holding rates high for longer, which is probably not enough to bring down inflation while putting growth at risk; or further raising rates, potentially triggering a recession—in an election year! About now, Powell probably wishes he’d chosen to write songs instead of running a central bank.

Financial Conditions Remain Loose

SOURCE: Federal Reserve Bank of Chicago.