Eyes on the Economy: Retail, Industrial Production, Sentiment

Retail Sales Continue Nosedive

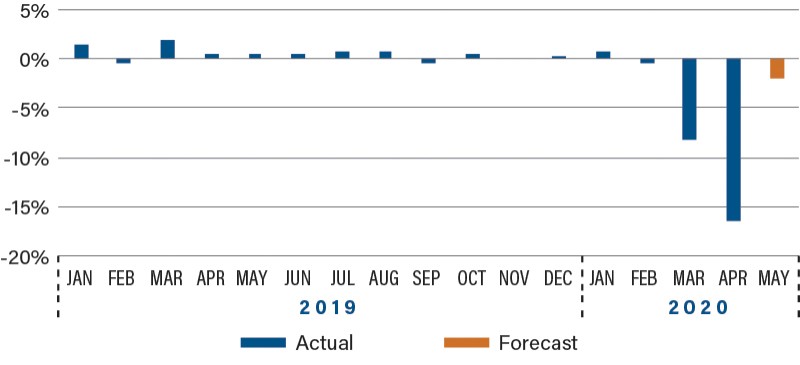

As lockdowns continued, consumers were hit from all sides with job losses, furloughs and, as expected, spending is nowhere to be found. The rapid fall in April retail sales of 16.4 percent shows just how severely the lockdowns disrupted the U.S. economy. Retail sales measure purchases at stores, restaurants and online. According to the Commerce Department, April’s drop was the biggest ever recorded.

It will take time for sales to begin their slow climb up as states slowly reopen their economies. Social distancing, business closures, travel restrictions and other disruptions that started in mid-March have taken a heavy toll on retail stores and restaurants, many of which remain closed or are opening gradually with reduced capacity.

For example, the state of Nevada has the highest unemployment in the U.S. at 28.2 percent. The reason is straightforward: Nevada’s number one industry is arts, entertainment, recreation, accommodation and food service. Interestingly, this industry sector ranks sixth nationally. All state economies should improve as states gradually reopen.

COVID-19 Bites Retail Sales

(Month-Over-Month Retail Sales Growth)

Industrial Production Declines

Another record was set in April, although not one the U.S. economy wants, as industrial production fell 11.2 percent. The drop was slightly below consensus forecast of -11.5 percent. The decline in production indicated manufacturing, mining and utility output were all significantly down.

Manufacturing output dropped 13.7 percent, and motor vehicle and parts production were a drag, plunging 71.7 percent. The manufacturing output pullback was its largest monthly decline dating back to 1919.

All is not lost though, as economists expect to see an output resurgence similar to the retail sector. As states ease their stay-at-home orders and reopen nonessential businesses over the next couple of months, a bounce in output is likely to occur. Overall, manufacturing likely won’t see a V-shaped recovery. Some segments will fare better than others, including food processing and technology.

Unfortunately, the same cannot be said for the automobile industry as flipping a switch from off to on is not feasible due to the danger to factory workers’ health and safety. Production facilities that restart will have strict health protocols in place. Factories will use personal protective equipment, daily temperature checks and health screenings.

Economists anticipate that demand for autos will rebound more quickly than production.

Sentiment Hits Bottom

Although the free fall in consumer sentiment seems to be over, confidence—which a few months ago was near historic highs—is now at a level we would expect given the recession the U.S. economy is suffering. The preliminary reading for May from the University of Michigan was 73.7, up from 71.8 in April, and an implied reading of about 73.0 in the second half of April. Even with this glimmer of light, confidence is down 27.3 points from February.

Another bright spot is that consumer sentiment inched higher over the last month and remains comfortably above the levels seen during the Great Recession when the index fell into the 60s. This may reflect the suddenness of the decline, hopes for a speedy recovery as the economy reopens and consumers’ far better financial position prior to the pandemic.

The bottom may be at hand for confidence, but the timing of any rebound remains highly uncertain. Many businesses have been forced to shut down, throwing consumers out of work in unprecedented numbers. More than 40 million people have filed for unemployment insurance in just the last 10 weeks.

All referenced economic data sourced from Bloomberg.

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| Retail Sales (Apr.)(MoM) | -8.7% | -9.5% | -16.4% |

| University of Michigan Sentiment (May) | 71.8 | 68.0 | 73.7 |

| Industrial Production (Apr.)(MoM) | -5.4% | -11.5% | -11.2% |