Eyes on the Economy: Retail Sales, Unemployment

Retail Sales Improve But Lag Historical Expectations

Consumer spending showed continued recovery in June as retail sales exceeded expectations, though the tallies remained below pre-pandemic projections. More stores were open in June, and fewer folks were under stay-at-home orders.

As a general rule, the hardest-hit retail segments saw faster growth in May and June, although many are still posting sales far below pre-crisis levels. It is unclear if the uptick will continue in July as many areas are slowing reopenings.

The disruptions remain clear in the data, although there are some remarkable recoveries as well. Many economists are closely watching gas consumption since activity at the pump is a proxy for how much people are getting out and about again. Gasoline prices fell rapidly in both March and April, months that historically see a rise in prices as the spring and summer driving seasons approach and take effect. This year, however, demand for fuel plummeted as fewer workers were on the road and leisure travel plans were canceled. Prices and driving rebounded partially in May and more in June—though the cost of gasoline remained more than 50 cents a gallon below its year-ago average.

Meanwhile, sales at apparel stores were down 23 percent compared with February; restaurant receipts were down 27 percent; and sales at appliance and electronics stores were off 12.5 percent.

First-Time Jobless Claims No Longer Falling

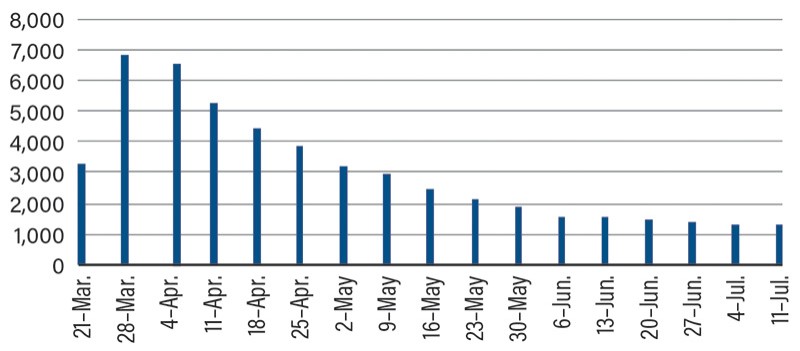

After months of steady declines, initial jobless claims remain stuck at more than 1 million new filings per week, producing deep concern among economists. The 17-week total since the pandemic began now stands at 52 million.

The disturbingly high level of continued initial claims shows that businesses are still laying off workers as a result of reduced demand and social-distancing constraints. Up until now, reopenings have fueled rehiring. The jobs that have returned are mostly in retail, restaurants and healthcare offices—all jobs considered low-hanging fruit that economists expected to come back early as reopening began. Now, however, the employment outlook becomes murkier. It’s going to get harder to bring back jobs as government aid for small businesses expires and consumers remain skittish about spending money.

The three most populous states—California, Texas and Florida—are now scaling back reopenings as new daily COVID-19 cases spike. The timing could not be worse. Many businesses were desperately waiting for demand to bounce back to normal in order to recoup lost revenue from earlier lockdowns. The return to more stringent guidelines and even closures may tip the scales from rehiring outpacing layoffs to the reverse—layoffs overtaking rehiring—causing both initial claims and continuing claims to increase. To make matters even worse, permanent job losses are also picking up—rising to 2.9 million in June.

Weekly New Jobless Claims

(Numbers in Thousands)

All referenced economic data sourced from Bloomberg.

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| Retail Sales (June) (MoM) | 17.7% | 2.3% | 7.5% |

| Jobless Claims (July 11) | 1.314 M | 1.284 M | 1.300 M |

| Unemployment Rate (June) | 13.3% | 12.5% | 11.1% |