Bankruptcies Are Picking Up; Are We Eyeing a Corporate Storm?

In the previous Solutions issue, we featured an upcoming storm caused by credit card debt. It appears that it isn’t the only turbulence heading our way. Another resilient segment of the U.S. economy is also about to face the reality of high borrowing costs. Debt defaults by U.S. corporations reportedly surged 176% in the first eight months of 2023 from the same period a year earlier.

With massive COVID-era liquidity support, the U.S. corporate default rate fell drastically from its initial spike after the pandemic hit the economy. S&P Global reported that, from 2017 to 2021, corporate issuers were able to come to market at coupon rates well below those on their existing debt. Money was abundant, a concept that led us to the current macroeconomic condition. Then reality hit us: We woke up to decades-high inflation, a sudden rise in interest rates and a volatile economy that keeps sending mixed signals to the markets, causing uncertainty in every corner.

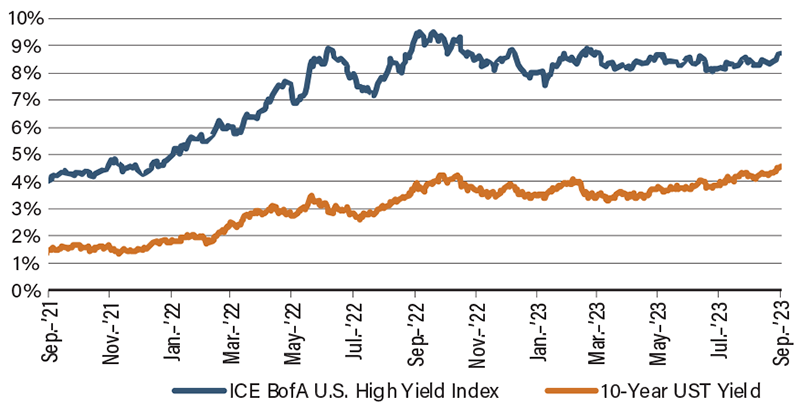

Interest rates on corporate debts are benchmarked to government bond yields, which have surged following the hikes in the Federal Reserve’s overnight rate. Ten-year U.S. Treasury (UST) yields increased 350 basis points between September 2020 and September 2023. The 12-month forecast for the 10-year UST yields suggests that the rates will continue to rise and remain high throughout 2024. Meanwhile, companies are staring at debt securities that are about to mature. An estimated $790 billion of corporate debt is set to mature in 2024, followed by $1.07 trillion in 2025, according to Goldman Sachs. Once their existing debt matures, companies will have to go to market at much higher coupon rates for funding. The burden of rising interest rates will be heavier on lower-grade corporate issuers. The speculative-grade default rate is projected to rise from 3.2% to 4.5% by June 2024.

Corporate debt distress is also a cause for concerns about bankruptcy. S&P Global reported that, in the first half of 2023, U.S. corporate bankruptcies surged to the highest level of any first-half period since 2010. The number of company failures reached almost 3,000—a 68% increase from the same period last year. This appears to be more serious than a tropical depression. We are calling it a hurricane in the making.

Non-Investment-Grade Corporate Yield vs UST Yield

Source: Federal Reserve; ICE Data Indices, LLC.