Eyes on the Economy: Optimism, Inflation, Oil Rigs

Small Business Optimism Dips Amid Rising Uncertainty

The National Federation of Independent Business’s (NFIB) Small Business Optimism Index fell 2.0 points to 98.8 in September, marking its first decline in three months but staying above the 52-year average. NFIB’s Uncertainty Index rose sharply to 100, the fourth highest in the last five decades. Inflation and supply chain issues were major concerns, with 14% of owners citing inflation as their top problem and 64% reporting supply disruptions. Price pressures persisted, with 24% raising prices and 31% planning further increases. About 18% cited labor quality as their most critical problem, while 32% reported unfilled job openings. Earnings trends improved to their best level since December 2021, but expectations for better business conditions dropped 11 points. Capital spending and sales expectations weakened slightly, while borrowing costs and loan difficulties increased. Despite challenges, most owners still rated their business health as good or excellent, though fewer viewed it as a good time to expand.

Inflation Expectations Edge Higher

Median inflation expectations rose slightly in September, with the one-year-ahead outlook increasing to 3.4% from 3.2% and the five-year-ahead outlook edging up to 3.0% from 2.9%. On the other hand, the three-year expectation held steady at 3.0%. The largest year-ahead increases were seen among respondents with a high school education or less and those with household incomes below $50,000. Meanwhile, median one-year-ahead earnings growth expectations fell by 0.1 percentage point to 2.4%, the lowest since April 2021. Labor market sentiment weakened, as mean unemployment expectations—the perceived likelihood that the national unemployment rate will be higher in a year—rose 2 percentage points to 41.1%. Similarly, the average perceived probability of losing one’s job in the next 12 months climbed 0.4 points to 14.9%, exceeding the 12-month average of 14.1%. Overall, the data suggest rising inflation concerns alongside softening income and employment confidence.

Baker Hughes Oil Rigs Slip, Potentially Starting to Plateau

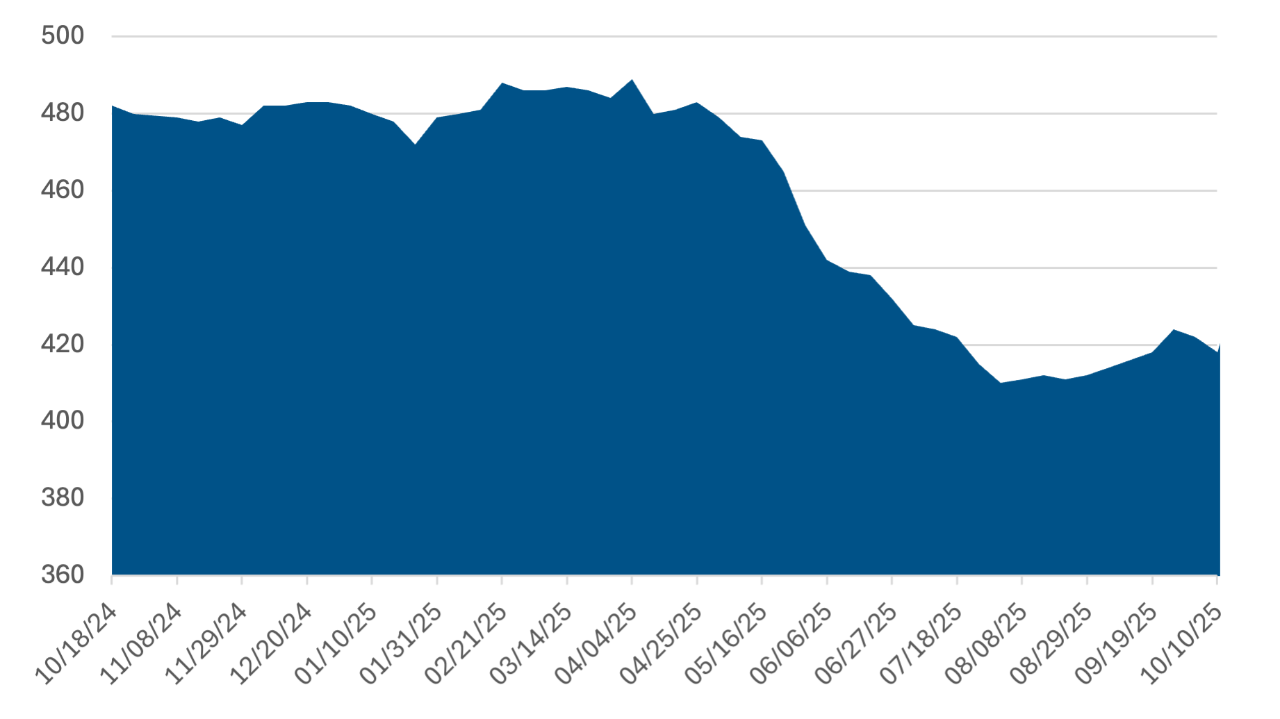

The Baker Hughes U.S. oil rig count slipped to 418 for the week ended October 10, a three-week low and slightly below expectations. At 418, activity sits roughly 16.3% below the longrun average of 499.5 and far below the October 2014 peak of 1,609. Rig count started falling in April and has settled at a lower level since August.

The weekly drop is small, but the direction signals continued capital discipline and selective drilling among U.S. shale operators, which are prioritizing shareholder returns over raw growth. Importantly, today’s lower rig count does not translate one‑for‑one into lower production. Productivity in the oil industry has increased thanks to advances like longer lateral wells, automation and stronger equipment, enabling companies to extract more with fewer rigs and less investment. Laterals are longer and draws on drilled‑but‑uncompleted (DUC) inventory can cushion output in the near term. If below‑trend rig activity persists, it generally points to slower U.S. supply growth rather than outright declines. Key signals to monitor are changes in completion crews, DUC inventories and any regional skew (e.g., Permian vs. non‑Permian) that might reveal whether this dip is noise or the start of a plateau.

Oil Rig Count Plateauing at a Lower Level

Source: Trading Economics.

Recent Economic Releases

| Indicator | Prior period | Current period (forecast) | Current period (actual) |

|---|---|---|---|

| NFIB Small Business Optimism (Sept.) | 100.9 | 100.5 | 98.8 |

| One-year-ahead Consumer Inflation Expectations (Sept.) | 3.2% | N/A | 3.4% |

| Three-year-ahead Consumer Inflation Expectations (Sept.) | 2.9% | N/A | 3.0% |

| Baker Hughes Oil Rig Count (Week ending Oct. 10) | 422 | 421 | 418 |

Key Interest Rates

| 10/13/25 | 10/6/25 | Change | |

|---|---|---|---|

| Fed Funds | 4.25% | 4.25% | --- |

| 2-yr. UST | 3.52% | 3.60% | (0.08) |

| 5-yr. UST | 3.65% | 3.75% | (0.10) |

| 10-yr. UST | 4.05% | 4.16% | (0.11) |

| 30-yr. UST | 4.63% | 4.76% | (0.13) |

Rate Forecast — Futures Market

| Q4-25 | Q1-26 | Q2-26 | Q3-26 | |

|---|---|---|---|---|

| 3.75% | 3.50% | 3.25% | 3.25% | |

| 3.41% | 3.37% | 3.35% | 3.33% | |

| 3.63% | 3.62% | 3.63% | 3.63% | |

| 4.10% | 4.09% | 4.10% | 4.10% | |

| 4.65% | 4.64% | 4.65% | 4.64% |