Cheap Money, Expensive Homes: A Self-Defeating Cycle

For the average household, what seems more difficult: paying a 6.5% mortgage rate, or borrowing $375,000—the typical size of a home loan? In today’s economy, where inflation hovers just below 3% and annual stock market returns often reach double digits, a 6.5% interest rate is hardly irrational. What feels far less sensible is that the median U.S. household has only about $8,000 in savings yet routinely takes on six-figure mortgage debt. Still, the public debate fixates on interest rates—complaining that we can no longer borrow at near-zero cost—while far fewer voices demand meaningful housing affordability change.

Lenders lose money in real terms if they charge interest rates below the rate of inflation. Put simply, when inflation is higher than the interest earned, the money that lenders get back in the future buys less than it did when they lent it out. This is why inflation is such a powerful driver of interest rates; not only does it push the Federal Reserve to raise rates, it also reduces the future value of money, prompting investors to demand higher returns as compensation.

Here’s the twist—housing plays a big role in this cycle. Rising home prices feed directly into inflation, since housing costs make up roughly one-third of the consumer price index. A rise in the inflation rate further erodes the value of future money and creates upward pressure on interest rates. This means that, in the long run, relying on low interest rates to make housing seem affordable is self-defeating—the very rise in home prices contributes to the conditions that make low rates unsustainable.

Of course, there have been times when mortgage rates were kept low despite rising home prices. The government has tools—like guarantee programs and quantitative easing—that can keep mortgage rates low in the medium term, and it has relied on them for decades. But the consequence has been a steady climb in home prices and a population addicted to cheap money. Propping up low rates without tackling the underlying affordability crisis is like taking painkillers that ease the symptoms while slowly damaging the liver—the root problem only grows worse and the relief will soon become another illness.

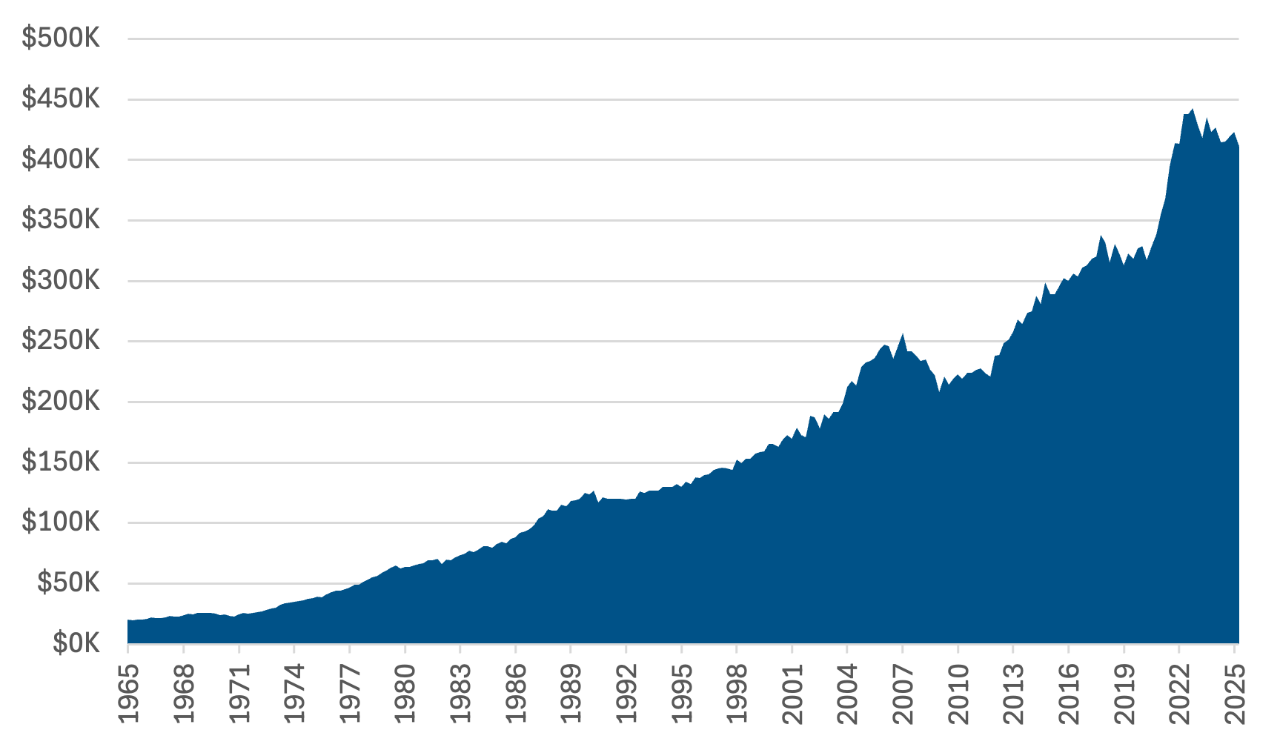

Median Home Sales Price

SOURCE: Federal Reserve Bank of St. Louis.