Banks Clamp Down on More Credit for Consumers

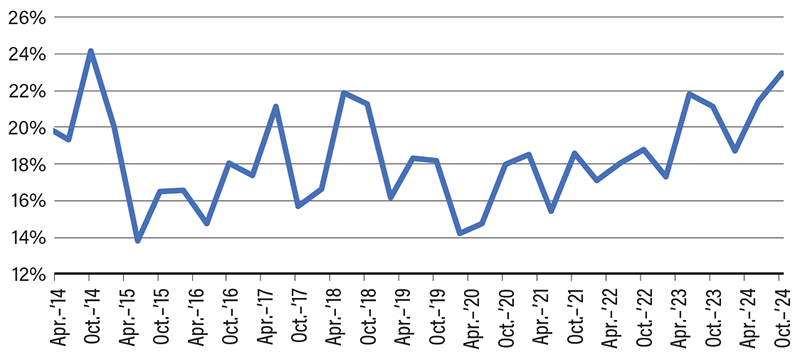

Rejections are always painful. When your crush says no, your heart hurts—but what if it’s your bank? An increasing number of U.S. households have had this experience recently as the average rejection rate for all consumer loan types reached 22.9% in October 2024, the second-highest number since records began in 2013. In its latest release, the Survey of Consumer Expectations shows that access to consumer credit has grown more restrictive even though the Federal Reserve started cutting rates back in September.

Before the pandemic, overall rejection rates averaged around 17.6%. For mortgage refinance, the rejection rate dramatically increased from 9.5% in October 2023 to 22% in October 2024. The auto loan rejection rate fell to 14.2% in October this year from the record high of 18.5% in June but was still above previous years when auto loan rejection rates averaged mostly below 10%. Another clear sign of restrictive access to credit is the new record high of the rejection rate for credit card limit increases, which rose drastically to 44.5% in October 2024, up from 32.1% in the same period last year. This figure ran well below 40% in all previous periods, except February 2021, when it was 40.3%.

Access to credit has been more restrictive for consumers of mid-level (681–759) credit scores. Those with low credit scores (below 680) have seen such low access before. It is Americans with mid-level credit scores that are facing the most change in their ability to tap credit since their rejection rate reached a record high of 19.9% in October. As expected, those with high credit scores (above 759) have maintained easier access to credit, with a rejection rate of only 2.6%. The figures suggest that lenders are tightening access for mid-level borrowers, who are the most impacted. Borrowers with low and high credit scores have seen less change.

Alarmingly, the average likelihood of needing $2,000 within the next month increased this year, recently reaching nearly 38%, the highest posting on record. Meanwhile, the average likelihood of coming up with that amount of money dropped to below 65%, the lowest on record. These figures suggest an increasing level of financial fragility among consumers at a time of more restrictive credit access.

Rejection Rate Climbs to Second-Highest Point on Record