Stocks Are Going Strong: Who’s the Fool Now?

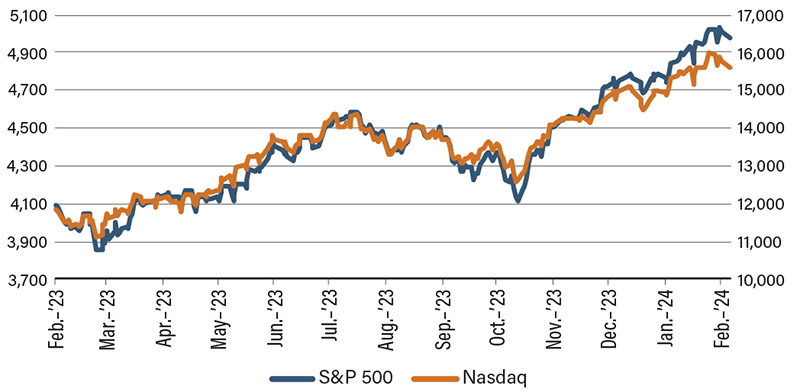

One true mark of a financial bubble is the willingness of participants to overexaggerate the value of an asset while turning a blind eye on cautionary signs—it’s a collective madness. It is hard to believe annual returns of 25% for the S&P 500 and a 35% increase for the Nasdaq Composite at a time when monetary policy is highly uncertain, a polarized election is approaching, two ongoing wars are on the verge of regional spillovers and a trade war is heating up between two superpowers. However, as long as market participants have the faith and willingness to do the mental gymnastics to justify the valuation, I suppose the show will go on.

How does that happen? It usually starts with the same story: Either a fool-proof investment (“real estate never declines”) or a promise to revolutionize the world. Markets have the tendency to oversell great things to willing buyers who fear missing out on the next life-changing investment. The internet really changed our life, but that didn’t mean dot-com companies weren’t massively overvalued in the 1990s.

Similarly, artificial intelligence (AI) has the potential to transform the world in ways beyond our imagination, but that doesn’t justify record-breaking stock prices in a monetary tightening cycle. Markets definitely price in for AI benefits, which may be overhyped or never deliver, but they don’t appear to price in for the risks. Financial market participants tend to react more strongly to positive news than negative news because, by nature, markets just want a reason to rally.

Previously, we suggested there would be corrections in the stock market. Instead, the U.S. stock market not only recovered to its 2021 high but also broke new records. We learned our lesson. We certainly underestimated the practicality of the Greater Fool Theory—the idea that prices keep going up because people are able to sell overpriced assets to the next “greater fool.” Although there will be fluctuations in the current bubble, it won’t burst until we run out of greater fools. And in a world of over 8 billion people, that takes longer than we previously estimated.

US Stocks Make Impressive Gains